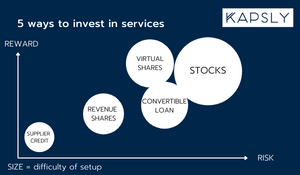

5 ways to invest your services into promising startups

One of the main reasons startups fail is because they run out of money or have the wrong team. You're thinking, "that has nothing to do with me," that's probably true. But maybe you could do something about it and actually help startups succeed while increasing your team's utilization and generating higher profits for your agency. This blog post is for service agencies who want to help startups build their company and share in their success.

Investing your services can be one of the best things you can do with your time. The rewards can be many times your normal revenue. In this post, you'll learn five ways service providers can invest their services. See which model makes sense for you and your clients.

1. The supplier credit, deferred payment with interest.

With supplier credit, you can bridge some time to your clients until they have more money. You won't get revenue until later, but it can help build a steady income and long-term customer relationships.

Supplier credit means you get paid later, but can add an interest charge to your outstanding invoice, increasing your profit by that extra margin.

The contract is easy to set up, you can simply set the terms with your customers. Another benefit could be that you build long-term partnerships by securing a minimum volume of business or duration of cooperation in return for the friendly payment terms. The flip side of the coin is that you need to be able to close the financial gap. If you have high upfront costs or low capital reserves, this is probably not for your business.

In any case, it has to be worth it for your customers to pay the interest rate. You can't force such a model on anyone who doesn't need it unless you just keep offering long payment terms and raise your rates. Then your customers would not perceive the interest payment as such, but it would be a strategic pricing decision. Typically, supplier loans are for service providers in an industry where you can trust your customer to pay you later. Typical industries are B2B retail, manufacturing, or FMCG (fast-moving consumer goods).

2. Revenue shares, bring success and benefit from it.

If you want to prove that you help your customers succeed and are confident in doing so, this model is ideal. It may also be necessary if you have only a few big customers and depend on them.

There are two main types of revenue share. Either as a fixed amount per item sold or as a percentage of the customer's revenue. In the latter case, you leave it up to the market to determine the value of your services, and give your customers the freedom to adjust prices (while maintaining their gross margin).

In this model, the client's future revenues should be readily predictable. Different future expectations could lead to longer negotiations, especially if there is no comparable business model. The parties should also agree whether the compensation is limited in time to the duration of the partnership or whether there should be a maximum payback period with a cap after the partnership ends.

Revenue sharing is most useful when you have a direct impact on your client's revenue. This is most likely the case with sales and marketing services. The concept can also be found in professional sports, outsourced production services, or intellectual property licensing.

3. Stock, become a real shareholder.

If you really want to become an owner of a business, then stocks might be the right thing to do. However, in many cases you are expected to invest money as well.

When you acquire real stock of your client’s business you become a shareholder with all its rights. You should be treated like any other investor, and you also carry the same risk.

Stocks are basically the most valuable thing a startup has to offer. You get voting rights and a 100% share in the value creation of the company. However, you may have to provide some cash to get the stocks. Ideally, you'll only pay the nominal share price, but then the deal should be at an early stage where the risk is still relatively high. Alternatively, you could use stock options with a low strike price. In that case, you can wait until an exit is due and only then exercise the option. If you buy the shares, the startup/client may use this money to pay for your services. However, you need to have enough cash in the bank to “pay” for your own services upfront (i.e. the investment). Out of all options, this is the riskiest one.

For smaller to medium sized projects the effort, including all the paperwork and legal fees, is probably not worth it. However, if you are really into a project, maybe even as a cofounding partner, you might prefer to get real stocks. Stock options could be a nice middle way, but also there the startups must be prepared accordingly. We see this model among Marketing- and Software-Agencies who sometimes take interim CMO/CTO roles to help build up the startup and continue the collaboration.

4. Convertible non-cash contributions, test the waters.

If a new client’s business case really excites you, but they need some financial support to get further, the convertible loan approach could be interesting.

In a convertible loan the investor provides a loan that can be converted into equity at a later stage under certain conditions. Usually, the parties define a maximum valuation of the startup (i.e. valuation cap) and/or a discount on the valuation at which the loan will convert into equity. In the case of service investments, the investment amount is not cash but the uncompensated service value.

One of the main advantages is that with this approach you have time to get to know your client. After a certain time of collaborating, you can better judge if the startup will be successful and if this turns into a long-term partnership. A prerequisite would be that you do not have a mandatory conversion. If the services have been invoiced before, the startups book a liability. At the time of conversion, a board consent is required as it represents a capital increase and hence a shareholder agreement with the supplier is necessary.

As stated initially, this model may be used when you are working with a new client and need to build a good relationship at first. If you invoice the services, it also gives a bit more security as you can claim your receivables before the conversion, but it also depends on the terms of your agreement. Be aware that many lawyers have experience with convertibles but only very few with convertible service agreements.

5. Virtual shares, financial benefits with less paperwork, the pragmatic approach

Do you want to invest your services to make your clients successful without becoming a real shareholder? Virtual shares or also called phantom stocks make it possible.

With virtual shares, you receive a right to a cash payout that is equivalent to the value of a defined number of shares at a certain event (such as an exit). The investor does not receive real shares and has no voting rights. Nevertheless, virtual shares dilute the normal shareholders and hence it is recommended that the startups acknowledge the effect of virtual shares in their shareholder agreement.

Virtual share agreements are simple to set up as they are only a bilateral agreement between the startup and the service provider. In the DACH region, this concept is well established for employee incentive plans. Depending on the type or length of collaboration the parties could also agree on an earlier payback option, such as after a qualified funding round. One issue could be that the payout does not happen automatically and you kind of need to trust that the other party will oblige to the agreement.

If your clients plan to make an exit or raise a larger amount of funding, this approach could be very interesting. You basically have the same financial upside as with normal shares but the setup is a lot less bureaucratic, and hence faster and cheaper.

The options above are not mutually exclusive and can come in many variations and combinations. Whenever you consider investing your services, you should put on your investor hat. Think about your investment budget, how much can you really afford. In your case you are not losing money but precious time, so use it wisely. At KAPSLY we propose a solution that combines convertible loans and virtual shares.

Check out our next blog to learn more about it and have a look on our marketplace. Please leave comments below